How To Finance a Car in 2024

Some of the links on this page may link to our affiliates. Learn more about our affiliate policies.

Last Updated: October 6, 2023

Are you looking to purchase a car but do not know how to finance it? This guide will walk you through the basics of auto loans and provide tips on securing the best loan for your needs. From understanding interest rates to improving your credit score, I'll cover everything you need to know before signing the dotted line. Plus, I'll explore alternative financing options for those not qualifying for traditional auto loans.

I have financed two cars in the past 14 months, and even with interest rates being the way they are right now, I managed to work out good deals. However, securing solid financing was more complex than some dealers might make you think. So please take the time to understand how auto loans work and how to get the best deal possible in your current situation.

Understanding Auto Loan Basics

An auto loan is one of the most common car financing options. This type of loan allows you to borrow money from a lender to purchase a vehicle. The lender typically requires monthly payments, including principal and interest, until the loan is fully paid.

Before applying for an auto loan, it's important to understand how lenders calculate your monthly payment amount. Factors such as your credit score, down payment amount, and the loan term length all play a role in determining your interest rate and overall financing costs. You can secure the best possible auto loan for your car purchase by researching and shopping with different banks or lenders.

What is an Auto Loan?

An auto loan is a type of financing that allows individuals to purchase a vehicle by borrowing money from a lender. The borrower then pays back the borrowed amount, plus interest, through monthly payments over an agreed-upon period. Auto loans are often offered by banks and credit unions, as well as car dealerships themselves.

Auto loans work by determining the total cost of the vehicle minus any down payment made by the borrower. This amount is then financed, with interest added based on credit history and loan term length. Monthly payments are calculated based on this total amount financed and agreed-upon interest rate.

The benefits of getting an auto loan include:

- Being able to afford a more expensive vehicle than one could pay for upfront.

- Establishing or improving credit history through timely payments.

- Securing better interest rates through shopping around with different lenders or negotiating with the dealership.

Types of Auto Loans

Secured vs. Unsecured loans: Which one is right for you? A secured auto loan is a loan that requires collateral, such as the car itself. On the other hand, an unsecured auto loan does not require any collateral and can be used to finance any vehicle. Considering your financial situation before choosing between these two options is important.

New car vs. used car loans: What's the difference? New car loans typically have lower interest rates and longer terms than used car loans. However, a used car may be more affordable for monthly payments if you're on a budget.

Dealer financing vs. direct lending options: Who should you borrow from? Dealership financing can offer convenience and flexibility when financing your new or used vehicle purchase. However, comparing their rates with banks or other lenders offering direct lending options is important. It is important to keep in mind that some dealers will tell you that you "must" finance through them, my advice for you is to walk away from such auto dealers. If you finance through them, their profit margin expands since they have a set agreed rate with the banks, and anything on top of that is profit for the dealer. However, their profits will come out of your pocket.

Overall, figuring out how to finance a new vehicle can seem daunting at first but understanding factors like secured/unsecured loans and dealer/direct lending will help ensure that you make an informed decision about your auto loan.

Factors That Affect Auto Loan Interest Rates

Your credit score and credit history are the primary factors that affect your auto loan interest rates. Lenders use this information to determine how likely you are to repay the loan on time. The better your credit score, the lower your interest rate will be. Other factors that can impact rates include:

- Loan term length: A longer repayment period may result in a higher interest rate because it increases the risk for lenders.

- Income level and employment status: Your income also affects your financing eligibility and the monthly payment amount you can afford.

- Credit score: As previously mentioned, your credit score is one of the most important factors in determining your interest rate. Lenders typically offer lower rates to those with good credit scores, while those with poor credit scores may be subject to higher rates or even denial of a loan.

- Type of vehicle: The vehicle you're financing can also impact your interest rate. Lenders may offer lower rates for newer, more reliable vehicles, while older or high-mileage vehicles may result in higher rates.

- Down payment amount: A larger cash down payment can help lower your interest rate, showing lenders that you're invested in the purchase and less likely to default.

- Comparable credit: It is good to have had comparable loan amounts that you have successfully paid off. For instance, if you are applying for a $50K auto loan but have never paid off even $25K, banks will be less willing to extend a loan offer.

- Trade-in: if you have a car to trade-in, it might help your situation, unless the car that you have is not very desirable by the dealer.

It's important to consider these factors when shopping for an auto loan from a bank or other lender to secure the best deal possible.

Hidden Add-Ons

Dealers love to add things that you might not necessarily need. I was just looking at a few Subaru Outbacks here in Michigan area and had this happened to me right away. The add-on that the dealer tried to quietly add into the car sales bill was the "Ceramic Coating Package" for $2,700. If you are not too familiar with ceramic coating, it is nothing earth shattering and should not cost you even near that amount. Even better, you can ceramic your own car with a YouTube tutorial and a Ceramic Coating for Cars kit.

At first, the sales person refused to take it off, but later decreased the amount by $2,000. The $700 was "prepping fee" which made no sense either way to me. So I was very iffy already.

What killed the deal is them trying to low-ball me on my 90k mile 2015 BMW 535i xDrive with MSport package trade-in appraisal. I was offered $11K and the dealer did not go above $12K for it. At the moment, Manheim auto auction MRR was around $14,500, which means that dealers themselves cannot buy a car like that for cheaper than $14,500 plus auction fees.

I ended up walking away from this deal not just based on unnecessary add-ons that were being pitched as life-or-death add-ons, but also how they tried to squeeze the last bit of money from me.

Most Common Hidden Add-Ons at Car Dealerships

One of the bigger money makers for dealerships are "service contracts" where dealership will sell you their version of an extended warranty. There are a lot of nuances when it comes to service contracts and dealers actually fixing the vehicle for you if something goes wrong, so if you do think it's a good thing to get one, read the fine print. It's not a good practice to believe that the fine print is there for your own well being.

Other add-ons can include:

- Fabric protection: dealerships love charging for bogus cleaning or "protection" fees. Keep in mind, that dealerships aren't specialized in doing fabric or paint protection (for the most part), so you are better off doing that yourself or at a professional shop.

- Gap insurance: not a bad idea to get it if you will owe more than what the car is going to be worth. If paid off early, the dealership should mail you the check for gap insurance that was not used.

- Rustproofing: usually this is a bogus charge since nowadays cars are way less likely to rust due to the rustproofing done by manufacturers.

- Service contracts: you really need to watch out for these. Some of the dealers become extremely pushy when it comes to selling clients their service contracts. A lot of times it's not the best deal for you.

- Wheel and Tire Protection Package: I haven't had great experience with this one. When I got my 2015 F82 Austin Yellow M4 with two tone M437 wheels, I couldn't use the BMW dealer package until the very last year because they couldn't match the color. However, I was able to replace one Michelin Pilot SuperSport tire, which at that time was priced around $500 at BMW.

- Nitrogen for Tires: this one is annoying since you can't even tell if they actually did it. A lot of times they will tell you that "it's a must" because they have already put the nitrogen into your tires. Last dealer I went to had a $700 charge listed for this.

- Windshield and dent protection: never had to use this one myself, so not much of an authority to give you advice on this one. However, as with everything else, please do your own research on the package provided and if it will be worth it.

- Many others, it really depends on dealership's creativity.

It all boils down to the value. You know best what has happened to your car in the past. If you are driving through gravel roads and get your windshield cracked twice a year, then it might be a good idea to get the Windshield and Dent Protection, otherwise, maybe not so much. Based on my personal experience, all of the extra packages were not worth it when purchased. Many times I ran into issues when trying to use the extra protections that I have purchased from the dealerships, which at that point became a headache.

Preparing to Finance Your Car

Securing the best auto loan for your car purchase starts with checking your credit score. A higher credit score typically means better interest rates and loan terms, so knowing where you stand before applying for a loan is important.

Once you understand your credit score, it's time to determine your budget. This involves calculating what you can realistically afford in monthly payments and factoring in other expenses like insurance, maintenance, and fuel costs. By setting a budget beforehand, you'll avoid overspending on a car that might not be worth the investment in the long run. Consider pre-approval from lenders to get an idea of what financing options are available to you before heading out to dealerships or private sellers.

Check Your Credit Score

Understanding your credit score is crucial to securing an auto loan. Your score, which ranges from 300-850, is a reflection of your financial history and affects the interest rate you'll receive on loan. Reviewing your credit report for errors or inaccuracies that could impact your score is critical before applying for an auto loan. Taking steps towards improving your credit score, such as paying down debt or disputing errors on your report, can increase the chances of securing the best possible interest rate and saving money in the long run.

If your credit history is not stellar, consider companies such as Lexington Law to help fix your credit. Companies that focus on credit repair can send a series of communications that are required by law to be responded to. If no response comes in, or if there is insufficient evidence (poor record keeping), the record might drop off from your credit report. However, keep in mind that's not always the case and some of the records are impossible to remove, as well as most financial companies do have great record keeping practices.

Determine Your Budget

When determining your budget for a car purchase, there are several factors to consider. First, calculate all costs associated with owning a car, including insurance, maintenance, and fuel expenses. By doing so, you can ensure that the monthly payment fits within your overall budget.

Next, think about financing options that work best for you. Longer loan terms or lower interest rates may be viable choices depending on your financial situation. Additionally, factor in any trade-in value from an existing vehicle towards purchasing a new one.

Carefully considering these aspects of auto financing and keeping close tabs on your finances during this process will help ensure you secure the best possible auto loan for your next car purchase.

Do you have a car to trade-in?

If you have a car to trade it, that will lower the amount that you have to finance. In the image above, I was able to get a good amount for my 2011 Acura TSX V6 with Technology Package and 189K miles, when I was purchasing the 2015 BMW 535i xDrive. This happened at the Acura dealer, which makes me believe that trading the same brand car that the dealership is focused on, can play in your favor. At first I was offered $3K for the car, but ended up getting $6,500 simply because I didn't mind walking away. Main point here is that you cannot act desperate.

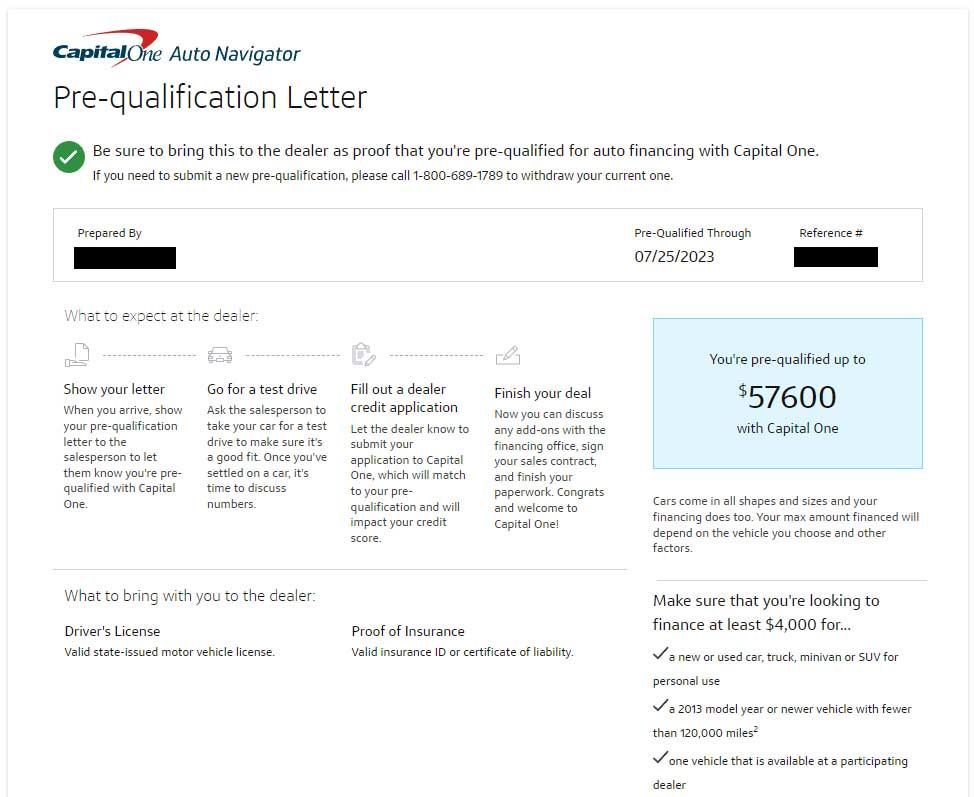

Consider Pre-approval

Researching and comparing lenders offering auto loans is crucial before seeking pre-approval. Knowing the rates and terms various lenders offer will help you find the best deal. When seeking pre-approval, provide accurate information about yourself to receive an accurate quote from potential lenders. While pre-qualification does not require you to show proof of income, once you get to the purchasing of a vehicle, you run a high chance of the lender asking for your financials.

It's important to understand the difference between prequalification and pre-approval when considering financing options for a car purchase. Prequalification only guarantees approval, while being preapproved shows dealerships how serious you are about purchasing a vehicle. These steps can save time, reduce stress, and increase your chances of securing the best auto loan possible for your future car purchase.

I have always brought a pre-approval to dealerships where I found the cars I wanted to purchase. Last time I did that, dealership went out of their way to negotiate a better rate for me via their own financing company. Also, if purchasing a vehicle out-of-state, you will save yourself a hassle in case something goes wrong during the finance inquiry at the dealer.

Tips for Getting the Best Auto Loan

Shopping around for the best interest rate is important when financing a car. Even a small difference in interest rates can significantly impact the total cost of your loan over time. Feel free to negotiate loan terms with lenders and ask for better rates or shorter repayment periods.

Avoid long-term loans if possible, as they often come with higher interest rates. It's also crucial to understand the total cost of the loan, including any extra fees that may be added on top of the principal amount borrowed. Doing these things allows you to secure the best auto loan for your car purchase while controlling costs.

Shop Around for the Best Interest Rate

Shopping around for the best interest rate is important when financing a car. Refrain from settling for the first offer you receive from a lender. Instead, check with multiple lenders to compare loan options and find the best rate that suits your financial situation.

Consider credit unions as well, as they often offer competitive rates and personalized service. By taking these steps, you can secure an auto loan with better terms and save money in the long run.

Negotiate Loan Terms

Knowing your budget beforehand is crucial when negotiating loan terms for a car purchase. It's important to clearly understand how much you can afford in monthly payments and overall cost. Being realistic about your financial situation will help you avoid taking on more debt than necessary.

When negotiating loan terms, be willing to discuss both the price of the car and the specific terms of the loan agreement. This includes interest rates, length of repayment period, and any additional fees or charges that may apply. Be bold and ask questions and consider alternative options if they better align with your financial goals.

If necessary, consider enlisting a co-signer for your auto loan. This person should have good credit history and be willing to vouch for you as a responsible borrower. Remember that defaulting on payments could damage both your and their credit scores, so make sure you can meet all payment obligations before making this decision.

Avoid Long-Term Loans

When financing a car purchase, it's important to avoid long-term loans, unless you are doing something called "car hacking." While longer loan terms may result in lower monthly payments, they can significantly increase the total amount of interest paid over time. Understanding the impact of a longer loan term on interest paid is crucial, and ensuring that monthly payments fit within your budget is crucial.

To avoid long-term loans, consider saving up for a larger down payment. A higher down payment can reduce the amount borrowed, resulting in shorter loan terms with lower interest rates. Additionally, shopping around for the best interest rate and negotiating favorable loan terms can help you secure an auto loan without committing to lengthy repayment periods. By taking these steps, you can ensure that your auto financing aligns with your financial goals and helps you achieve long-term financial stability.

Understand the Total Cost of the Loan

Factor in all fees associated with the loan, not just the interest rate. While a low-interest rate is important for securing an auto loan, it's also essential to understand the total cost of the loan. Make sure to inquire about any additional fees or charges that may be added to your monthly payments to budget for your car purchase accurately.

Read all documents carefully before signing anything. It's crucial to read through all paperwork associated with your auto loan before signing on the dotted line. This will help ensure you fully understand each agreement aspect and know potential hidden costs or penalties.

Ask questions about any unclear or confusing terms. Feel free to ask questions about a specific term or condition outlined in your auto loan agreement. Your lender should be able to provide clear explanations and definitions so that there are no surprises.

Other considerations when understanding the total cost of a car include calculating taxes, insurance rates, and maintenance expenses into overall ownership costs over time rather than just looking at what monthly payments might look like initially when getting an estimate from lenders who offer financing options such as leases versus loans where applicable based on credit scores as well - take these factors seriously if they apply!

Example of a Bad Auto Loan

While car shopping it is important that you understand the loan crystal clear. I have seen some atrocious car buying deals that have happened within my immediate family. So let's take an example of one of them:

- Car that's being purchased: Brand new Honda Accord for $25K

- Trade-in value: $8K

- Loan left on trade-in: $5K

- Cash down payment: $5K

- Loan term: 72 months

- Car payment: $650

As you see, this deal is not great for whoever is the buyer. All in the person ended up having to pay $54,800 if making minimum payments and not paying off the loan early. The car is only $25K and interest rates at the time were pretty good. So what happened? Let me break it down what makes up the $29,800 difference:

- True trade-in value: $8K - $5K = $3K

- Cash down: $5K

- What's left: $17K

So far pretty good, so what went wrong here?

- Ceramic coating: $2700

- Rust-proofing: $1100

- Gap Insurance: $1100

- Service Contract: $2100

- Total: $7000

Next you have sales taxes, and since this was in Illinois, they were hefty:

- Taxes: $3280

Current total financed is now: $27,280

Next part is the most painful one. Dealer was able to use the fact that the person buying the vehicle was an immigrant who didn't speak English well only kept pointing at the monthly payment of "only" $650/month. At the same time pushing the person to hurry up "because another client is interested in that same vehicle." Remember how I said that you should shop around for interest rates and how dealers want you to finance with them? Imagine how massive of a cut this dealer got from pushing this person to sign up for an auto loan at 19.5% interest rate. I almost got a heart attack after seeing the paperwork for this deal. The worst part, it was my immediate family member who didn't want me to tag along during his car buying experience.

Over the course of 72 months (6 years), my dear relative ended up paying $19,200 in interest. Worst part is, even if you re-finance, you pay the bigger portion of this interest at the earlier life of the auto loan.

Alternative Options to Auto Loans

If you're looking for alternative options to auto loans, a few choices are available. One option is to obtain a personal loan from your bank or credit union. Personal loans often have lower interest rates than traditional auto loans and can be used for any purpose, including buying a car.

Another alternative option is leasing a car instead of purchasing one outright. Leasing allows you to make lower monthly payments on the vehicle since you only pay for its depreciation during the lease term. Remember that at the end of the lease term, you will only own the vehicle if you decide to buy it out completely or enter into another lease agreement.

Personal Loans

Using a personal loan for car financing can be a convenient option, but weighing the benefits and drawbacks before deciding is important. One benefit is that personal loans typically have fixed interest rates and predictable monthly payments, making budgeting easier. However, personal loans may have higher interest rates than traditional auto loans and require collateral or good credit.

Lenders typically look at your credit score, income, debt-to-income ratio, and employment history to qualify for a personal loan. Improving your credit score by paying bills on time and reducing outstanding debt can increase your chances of being approved for a lower interest rate.

When searching for the best interest rates on personal loans, compare offers from multiple lenders. Look out for hidden fees or prepayment penalties that could increase the total cost of borrowing.

- Benefits and drawbacks of using personal loans for car financing

- How to qualify for a personal loan

- Finding the best interest rates on personal loans

Leasing a Car

Understanding the pros and cons of leasing vs. buying a car is crucial when deciding how to finance a vehicle. Leasing may offer lower monthly payments and the ability to drive newer cars, but it also means no ownership at the end of the lease term. Before signing a lease agreement, understand all the terms and fees involved.

When negotiating lease terms with dealerships, ask about any incentives or promotions available. Feel free to negotiate for a lower interest rate or a longer term if it fits your budget better. Also, pay attention to additional charges such as security deposits or early termination fees.

Calculating the cost of leasing over time involves more than just looking at monthly payments. Consider factors such as mileage limits and wear-and-tear fees that can add up quickly. It's important to weigh these costs against potential savings in maintenance expenses compared to owning an older car.

Overall, while leasing offers some benefits in terms of flexibility and affordability, understanding its limitations is key before making any financial commitments.

Using Home Equity Loans

Exploring home equity loan options for car financing can be a viable option for homeowners with substantial home equity. However, it is essential to understand the risks associated with using home equity loans for non-home expenses. The interest rates may seem attractive, but defaulting on payments could lead to property foreclosure.

Determining if home equity loans are right for your financial situation involves carefully considering factors such as credit score, income stability, and overall debt-to-income ratio. It's important to seek professional advice from a financial advisor or mortgage lender who can guide you through the process and ensure you make an informed choice that aligns well with your long-term financial goals.

How to Finance a Car: Final Thoughts

When financing a car purchase, finding the best auto loan is key. By researching and shopping around for rates, you can save yourself thousands of dollars over the life of the loan. Additionally, consider factors such as the down payment amount and loan term length when deciding.

It's important to remember that securing an auto loan is just one part of the car-buying process. Before signing any paperwork or agreeing to any terms, ensure you understand all aspects of the deal and feel comfortable with your decision. With careful planning and attention to detail, you can finance your dream car while staying within budget and avoiding costly mistakes.

Steven Dillon

Author

Steven is the founder and product tested for The Car Data, that has extensive knowledge in automotive industry. While most of his free time he participates in typical "car guy" activities, his passion for cars, data analytics, and tech, always has his looking for the next cool tool, software, trend, etc. to share with his audience on The Car Data or on his Instagram.