Infinite Auto Protection Review

Some of the links on this page may link to our affiliates. Learn more about our affiliate policies.

Last Updated: December 25, 2022

After the original warranty on your car has expired, an extended warranty is an excellent way to protect your finances from the high cost of repairs that may be necessary. Our team has investigated Infinite Auto Protection to help you find the best supplemental auto insurance by analyzing its plans, pricing, claims procedure, and customer reviews.

We also compiled a directory of the top auto warranty providers. Infinite Auto Protection offers a variety of vehicle service contracts, and we'll describe those plans and compare them to those of other companies we recommend below.

Infinite Auto Protection Overview

Infinite Auto Protection is an independent insurance agency based in Michigan that sells and manages used car service contracts (sometimes known as extended car warranties). It was founded in 2008, and in 2018 it received accreditation from the Better Business Bureau. All costs associated with fixing or replacing your vehicle in the event of a covered breakdown are covered by Infinite Auto Protection; all you have to do is pay your negotiated deductible.

Infinite Auto Protection is a solid choice for those in the market for used-vehicle extended warranties. But before committing either time or money, it's wise to look more closely. Our staff thoroughly analyzed Infinite Auto Protection and summarized our findings for convenience.

When filing a claim with Infinite Auto Protection, what should I expect?

The claims procedure is said to be quick and easy with Infinite Auto Protection. However, claims approval times may be longer than expected because the company is meticulous and adheres strictly to its policies. As seen in the sample contract provided on the website, Infinite Auto Protection has a maximum of sixty days to process any claim.

A contract requirement is that your car has had manufacturer-recommended maintenance, although the company does not always require proof of this. However, keeping your maintenance records on hand will help you immensely when filing a claim.

If your automobile has issues, you can take it to any service center that has earned recognition from the National Institute for Automotive Service Excellence. The service center will contact Infinite Auto Protection's claims supervisor to get the green light to begin repairs. All repairs must be approved to be covered by an Infinite Auto Protection service contract.

Keep in mind that Infinite Auto Protection reserves the right to conduct any necessary diagnostic inspections of your car or to transfer ownership of the vehicle to a different repair facility to investigate the claim. In addition, after repairs are completed, you will be responsible for paying that amount directly to the repair business if your plan has a deductible.

Infinite Auto Protection Reviews

The Better Business Bureau (BBB) has received 99 complaints about Infinite Auto Protection over the past three years, earning the company a grade of A-. It has a 2.38-star rating with the BBB and a 3.2-star rating on Trustpilot from its customers. There are only a few customer reviews on BBB or similar sites. A few customers we spoke with were unhappy with the lengthy wait times or had claims denied by the company. You must know what is and is omitted if you purchase a service contract.

Pros and Cons of Infinite Auto Protection Warranty

Pros

- The highest possible accreditation and grade from the Better Business Bureau

- Manages its programs

- Free return within 30 days

- The service is available around the clock.

Cons

- Provides only three packages, which may not address the needs of some vehicles and their owners.

- Advantages on top of that: Compared to competing services, coverage for lockouts and trip interruptions needs to be improved.

- Does not include details such as plan prices or deductibles.

Infinite Auto Protection Services

Age and mileage restrictions are incredibly severe

Several significant constraints severely constrain the possibilities for coverage provided by infinite. To give one concrete example, the brand may insure new customers as young as 19. A high maximum mileage limit makes it practical for use with older vehicles.

Additional Advantages

A bundle of extras is available to everyone who wishes to buy an Infinite warranty plan. Roadside assistance, rental cars, towing, and flexible payment plans are some of the repair options available.

Information on Coverage Can Be Found on the Website

Unlike competing companies, this one clearly outlines the many automotive systems covered by its various warrant tiers on its website.

24/7 Roadside Assistance

You are powerless to alter the conditions that led to your isolation. This means Infinite never takes a day off, literally. As a result of the convenience it provides, many companies that sell auto warranties include this service at no extra cost. You are guaranteed a good time no matter where you are or what happens.

Car Rentals

Just because your car is getting serviced doesn't mean you have to cancel all your plans. Your presence is required. To rephrase, Infinite's head start in the car rental market is crucial as it sets them apart from their rivals. You won't have to worry about getting around town if your car breaks down because they will cover the costs of fixing it.

Towing

If you find a garage that better manages your vehicle and has earned the ASE certification, Infinite will tow the machine there for you. The expense of calling a tow truck in the event of a car breakdown can quickly add up. Because this perk is built into the larger strategy, clients can take advantage of it without taking on any unnecessary risk financially. Hiring a tow truck is the best option for getting your car to the garage in one piece and promptly.

Flexible Compensation Terms

If you have Infinite, you can put off paying any remaining balance for as long as you like. They offer flexible payment plans tailored to fit your financial situation. The flexibility of their payment options makes it simpler to buy a program at a price that fits comfortably within your budget. Of course, it would help if you made the most of this chance to purchase auto insurance.

Infinite Auto Protection Coverage

Infiniti gives its customers several choices to keep their vehicles running smoothly and protect their investments. Some of the best features of the provided car warranty are as follows:

Major Systems

There is no risk of being stranded on Infinite if a crucial component of your driving machine fails. Everything from your engine to your gearbox to your brakes is taken care of for you. So you can unwind knowing that your traveling vehicle and bank account are safe from the costliest attempts to restore their former glory.

Drive Axle

Excessive shaking when a faulty drive axle assembly can cause steering. If this component is broken, your machine's equilibrium will be off, and your fuel efficiency will suffer. In addition, your machine's propulsion will become an uphill slog due to this. Infinite fills this void, offering complete security so you can rest easy.

AWD Coverage

The majority of service contracts do not protect 4WD and AWD vehicles. Fortunately, Infinite is here to help. This safeguards your financial security if any component of your 4WD system fails. That includes everything involved in the hypothetical transfer.

Cooling System

The cruising machine won't overheat thanks to its cooling system. Keeping this component in good working order is hazardous to your cruising machine and could lead to trouble in the future. Every element of the cooling system is shielded by infinity.

Transferability

You could transfer it to the next owner if you purchased an extended warranty. However, a processing fee of $50 will be added to the required certified selling documents. The warranty can be transferred to a new owner, but doing so will cost you a pretty penny.

Maintenance Records

You must service your vehicle according to the manufacturer's guidelines. Keep the receipts for the repairs if the company asks for proof that a certified repair shop did them.

Infinite Auto Protection Plans and Their Discounts

Since the costs of extended warranties are adjusted based on the specific vehicle being covered, they can vary widely. To this day, the price you pay for Infinite Auto Protection will depend on the type of vehicle you drive, the level of coverage you need, and the amount you choose to set aside each month as a deductible.

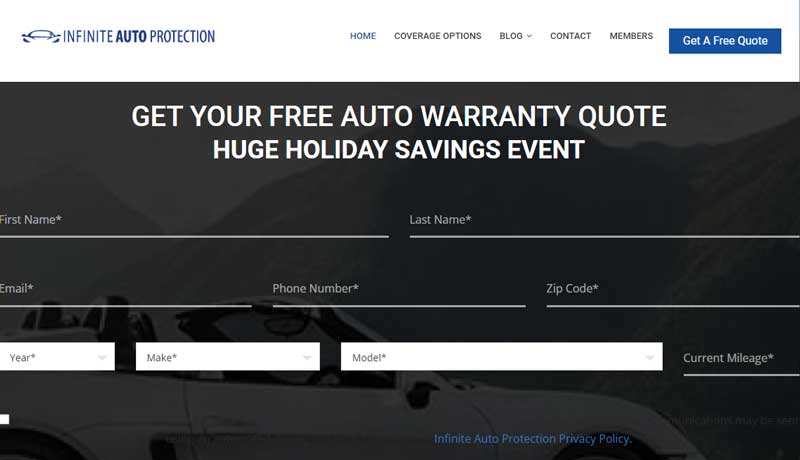

Fill out the online form or give Infinite Auto Protection a call to receive a free quote based on your vehicle's year, make, design, and mileage. Unfortunately, a three-year extended warranty could cost a customer $1,350, which is rather steep.

Infinite Auto Protection Review Bottom Line

We think that Infinite Auto Protection is a reliable auto warranty provider. Used car owners can get excellent service coverage and other perks with their plans. Owners of motor vehicles would consult a broker to figure out how much they can save and what conditions apply to the various contracts for which they may be eligible. Infinite Auto Protection should be a top consideration when shopping for a used car warranty.

Members of Infinite Auto Protection are entitled to a wide range of advantages. Paying in full or making a small monthly payment results in a discount. The business will also meet or beat competitors' prices by as much as 60 percent to help customers save money. In addition, 24/7 claims service is available with Infinite Auto Protection. Payments for legitimate claims filed by customers are issued without undue delay.

Additionally, you have 30 days to cancel your Infinite Auto Protection membership with no questions asked. Infinite Auto Protection offers a 30-day money-back guarantee, during which customers can request a refund if they are unhappy with the service.

The Car Data Review Methodology

Our expert review team is committed to providing honest and objective information. Based on consumer data, we identified the following rating categories and did extensive research to determine the top extended auto warranty providers.

- Affordable: Many factors influence the cost of a service, making it difficult to compare prices between providers. Our secret shopper team analyzes different vehicles, mileages, and warranty plans to give you this rating.

- Coverage - Each consumer has different needs. Every car warranty company must offer a variety of coverage options. We consider the number of plans available, terms limits, exclusions, and additional benefits.

- Industry Standing: Our team considers Better Business Bureau (BBB), ratings, availability, years in business, and other factors when determining this score.

- Customer Services: Trusted extended car warranty companies provide a level of customer care. We consider customer reviews, BBB complaints, and responsiveness to customer service.

Steven Dillon

Author

Steven is the founder and product tested for The Car Data, that has extensive knowledge in automotive industry. While most of his free time he participates in typical "car guy" activities, his passion for cars, data analytics, and tech, always has his looking for the next cool tool, software, trend, etc. to share with his audience on The Car Data or on his Instagram.

© 2023 The Car Data. All rights reserved.